Expanding your online presence globally requires a keen understanding of various search engine markets. The Japanese search engine market, dominated by giants like Google, is no exception, but it has its unique traits and key players that set it apart. This guide explores the specifics of the Japanese search engine landscape, providing valuable insights and strategies for effective search engine optimisation tailored to Japan.

Table of Contents

What is the Japanese Search Engine Market?

The Japanese search engine market refers to the collection of search engines and the ecosystem surrounding search behaviour, SEO strategies, and digital marketing practices specific to Japan. Key players in this market include Google, Yahoo! Japan, and Bing, each catering to a unique segment of users with distinct preferences and behaviours.

The search engine market in Japan is unique due to its diverse user base and the cultural nuances that influence search behaviour. Unlike many Western markets where Google overwhelmingly dominates, Japan’s market shows significant use of Yahoo! Japan and a growing presence of Bing, particularly in specific user demographics and device categories.

The History of Search Engines in Japan

The evolution of search engines in Japan has been marked by significant milestones. Yahoo! Japan was one of the earliest entrants, gaining a strong foothold due to its extensive localisation efforts and integration with popular services like email, shopping, and news. Google entered later but quickly rose to dominance due to its superior search algorithms and global reach.

Yahoo! Japan's strong presence can be attributed to its early market entry in 1996, which allowed it to build a robust user base before Google became a significant player. The strategic alignment of Yahoo! Japan with local needs, including its comprehensive Japanese-language support and integration with daily-use services like Yahoo! Chiebukuro (a Q&A platform), has kept it relevant even as Google gained global dominance.

Who are the Key Players in the Japanese Search Engine Market?

Google: Holds the largest market share and is favoured for its accurate search results and user-friendly interface. Google’s continuous improvements in localised content and mobile optimisation have solidified its position as the leading search engine in Japan.

Yahoo! Japan: Although it uses Google’s search algorithms, Yahoo! Japan remains popular due to its localised services and long-standing presence in the market. Yahoo! Japan's ecosystem includes services such as Yahoo! News, Yahoo! Shopping, and PayPay, which enhance user engagement and loyalty.

Bing: While having a smaller market share, Bing has shown growth, particularly in desktop searches, partly due to its integration with Windows OS and advancements in AI technologies like ChatGPT. Bing's focus on precise keywords and multimedia content also caters to specific user preferences in Japan.

Naver and Baidu: While less dominant, these search engines cater to niche markets within Japan, particularly for users who prefer services and features unique to these platforms.

Contact ULPA for expert help with

Search Engine Marketing in Japan

Market Share and Usage Trends

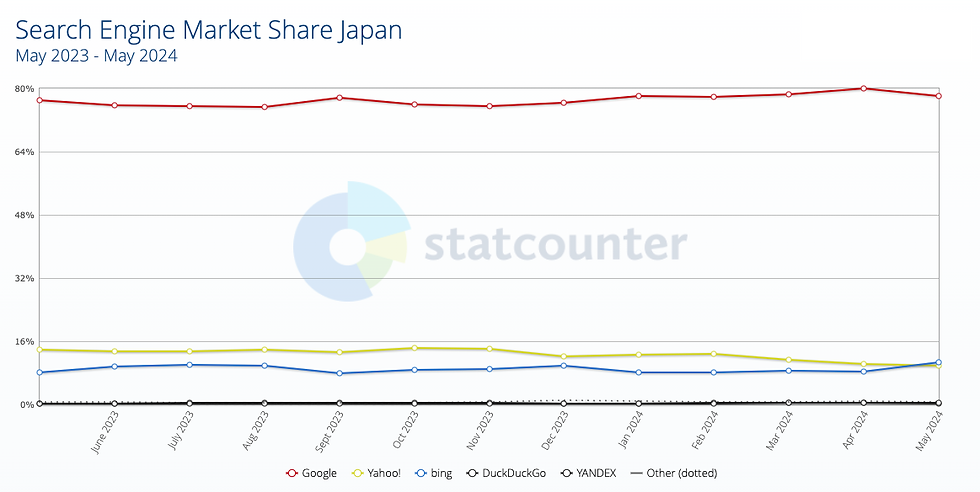

Thanks to the most recent data from StatCounter, we can see a notable trend: Bing has overtaken Yahoo! Japan in second place in total market share. In May 2023, Bing held 8.1% of the market share compared to Yahoo! Japan's 13.91%. However, by May 2024, Bing's share had risen to 10.72%, surpassing Yahoo! Japan's 9.76%. Looking into more granular data, we see that Bing's dominance comes from Desktop searches, which hold 2nd place to Google, with 71.22%, Bing 21.17%, and Yahoo! Japan 6.33%. In contrast, Yahoo! Japan is firmly in the 2nd place for Mobile search, with Google at 84.89%, Yahoo! Japan at 12.94%, and Bing at 0.75%.

Dominance of Google

Google maintains a strong lead across all platforms, with a consistent share averaging around 77% on all platforms, 72% on desktops, and 81% on mobile. Despite minor fluctuations, Google's market share has remained relatively stable, reflecting its continued strength in delivering accurate search results and a user-friendly interface.

Yahoo!'s Presence

Yahoo! is the second most popular search engine but has been experiencing a slight decline in market share across all platforms and desktops. However, it holds a more substantial share on mobile, around 17%, due to its long-standing presence and integration with various local services, which keep it relevant to Japanese users.

Rise of Bing

Bing has shown growth across all platforms, particularly on desktops, where it has seen the most significant increase, averaging around 18%. Bing’s innovative features, such as integration with Windows and AI enhancements thanks to Microsoft's investment in OpenAI and ChatGPT, might contribute to this growth, appealing to users seeking a different search experience.

Niche Players and Emerging Trends

DuckDuckGo, YANDEX, Baidu, and Naver have small but growing presences, particularly on mobile platforms. YANDEX and Baidu have shown notable growth percentages, indicating increasing usage and potential future shifts in user preference. This rise suggests a growing interest in alternatives to the major search engines, driven by unique features and localised content.

Possible Reasons for Market Share Shifts

Technological Advancements

Bing’s integration with AI and Windows ecosystem enhancements might be attracting more users. Additionally, Google’s continuous improvements in search algorithms and user experience help maintain its dominance, ensuring it remains the preferred choice for many users.

User Privacy Concerns

Growing awareness and concern about privacy could lead users to privacy-focused search engines like DuckDuckGo, which offer enhanced privacy protections compared to the major players.

Localisation and Regional Preferences

Yahoo!'s decline might be due to its failure to innovate or localise effectively compared to Google and Bing. On the other hand, regional players like Naver and Baidu gain traction due to their localised content and services catering specifically to Japanese and East Asian users, offering a more personalised experience.

Mobile vs. Desktop Usage

Increased mobile internet usage in Japan might influence the rise of search engines like Baidu and Naver, which are more optimised for mobile experiences. Meanwhile, the desktop search market remains more competitive with higher stakes due to professional and academic use cases, driving Bing's growth in this segment.

Contact ULPA for expert help with

Search Engine Marketing in Japan

Future Predictions

Google’s Continued Dominance

Google will likely maintain its lead due to its robust infrastructure, continuous innovation, and integration with various services and devices, ensuring it remains the go-to search engine for most users.

Potential Growth for Bing

Bing could continue to grow, especially if Microsoft continues to innovate and integrate AI more deeply into its services, making it an attractive alternative to Google for certain user segments.

Rise of Privacy-Focused and Niche Search Engines

DuckDuckGo and similar search engines might see increased adoption as users become more privacy-conscious. Niche search engines focusing on specific user needs or regional preferences might carve out more significant market shares, appealing to users looking for specialised features and content.

Implications for Investors in Search Marketing

Focus on Google for Broad Reach

Given Google’s dominance, investing in Google Ads and SEO for Google will yield the broadest reach and impact, ensuring maximum visibility for marketing campaigns.

Diversify with Bing

Bing’s growing market share suggests a worthwhile investment in Bing Ads, especially for desktop-targeted campaigns, allowing marketers to tap into its increasing user base.

Explore Niche Markets

Considering the growth of niche search engines, marketers should consider optimising these platforms to capture specific user segments, taking advantage of their unique features and localised content.

Privacy-Focused Marketing

As privacy concerns grow, tailoring marketing strategies to highlight privacy features and targeting users on privacy-focused search engines can be beneficial, appealing to the increasing number of privacy-conscious users.

Mobile Optimisation

With high mobile usage, ensuring that marketing campaigns are mobile-optimised will be crucial for maximising reach and engagement and capturing the significant portion of internet activity that occurs on smartphones.

SEO Strategies for the Japanese Market

Local Keyword Research: Focus on Japanese-first keywords, incorporating Kanji, Hiragana, and Katakana. Understanding slang and colloquial terms is crucial. Effective keyword research in Japan involves translating English keywords and understanding the nuances of the Japanese language and culture. Tools like Google's Keyword Planner and local insights from native speakers can provide valuable data.

Content Localisation: Create content tailored to local preferences, ensuring cultural relevance and engaging user experiences. This includes using local examples, addressing local issues, and incorporating cultural references that resonate with Japanese users.

Mobile Optimisation: Prioritise mobile-friendly designs and fast loading times as mobile searches surpass desktop searches in Japan. This includes responsive design, accelerated mobile pages (AMP), and ensuring that all website elements are accessible and fast-loading on mobile devices.

Leverage Yahoo! Japan’s Ecosystem: Utilise Yahoo! Japan’s various services for integrated marketing efforts, from shopping to news. Advertisers should explore Yahoo! Japan Ads for targeted advertising and use the platform’s reach and engagement with Japanese users.

Building High-Quality Backlinks: Develop a robust backlink strategy with links from reputable Japanese websites. This enhances credibility and improves search rankings on both Google and Yahoo! Japan.

Utilising Multimedia: Incorporate videos, infographics, and images that cater to Japanese aesthetics and preferences. This improves user engagement and aligns with the SEO practices favoured by Japanese search engines.

The Role of Mobile Search in Japan

With the widespread use of smartphones, mobile search is a critical aspect of the Japanese search engine market. Businesses must ensure their websites are responsive and optimised for mobile to capture this significant market segment.

Japan's mobile-centric culture means that most internet activity occurs on smartphones. Google's dominance in mobile search is partly due to the widespread use of Android devices, which default to Google search. To optimise for mobile, businesses should focus on user experience, including easy navigation, fast load times, and mobile-friendly content formats.

Voice Search Trends in Japan

Voice search is gaining traction in Japan, with increasing numbers of users relying on voice-activated assistants for their search queries. Optimising for voice search involves using natural keywords and ensuring accurate and concise information is readily available.

The rise of smart speakers and voice-activated assistants like Amazon Alexa and Google Assistant drives the growth of voice search in Japan. Businesses should consider creating content that answers common voice search queries, often phrased as questions, and ensure that this content is easily accessible to voice search algorithms.

Challenges and Opportunities in the Japanese Search Engine Market

Challenges:

Cultural Nuances: Understanding and incorporating cultural nuances in marketing strategies can be challenging for foreign businesses.

Language Barriers: Effective communication requires proficiency in Japanese and understanding local idioms and expressions.

Competitive Landscape: The dominance of Google and the strong presence of Yahoo! Japan create a highly competitive environment for new entrants.

Opportunities:

Localised Content: There is a significant opportunity for businesses that can create highly localised and culturally relevant content.

Growing Digital Adoption: The increasing use of digital platforms in Japan provides a growing market for online businesses.

Technological Advancements: Leveraging AI and machine learning advancements can enhance SEO strategies and user engagement.

Contact ULPA for expert help with

Search Engine Marketing in Japan

Comparative Analysis of Search Engines in Japan

To comprehensively understand the Japanese search engine market, let's compare the key characteristics and user demographics of Google Japan, Yahoo! Japan, and Bing.

Google Japan:

User Demographics: Predominantly used by younger generations, particularly those in their 20s and 30s.

Key Features: Strong mobile optimisation, integration with Google services like Maps and Drive, and advanced AI algorithms.

SEO Focus: Emphasises high-quality content, user experience, and mobile-friendliness.

Yahoo! Japan:

User Demographics: Popular among middle-aged and older users, with a wide age range of users.

Key Features: Comprehensive ecosystem including news, shopping, finance, and more. Uses Google’s search algorithms.

SEO Focus: Similar to Google but with additional emphasis on localised content and services.

Bing:

User Demographics: Higher usage among older age groups, particularly those over 50.

Key Features: Strong video search capabilities, integration with Windows OS, and advanced AI features like ChatGPT.

SEO Focus: Emphasises precise keywords, multimedia content, and social media integration.

Over the past year, Bing has consistently increased its market share, surpassing Yahoo! Japan in May 2024. This change reflects Bing’s improved search capabilities, AI technology integration, and default presence on Windows devices. This trend suggests businesses should not overlook Bing when planning their SEO strategies for the Japanese market.

The Future of Search in Japan

The Impact of Social Media on Search Behaviour in Japan

Social media platforms like LINE, Twitter, and Instagram significantly shape search behaviour in Japan. Many users turn to these platforms for information, recommendations, and reviews, which can influence their search queries and decisions. Businesses should consider integrating their SEO strategies with social media marketing to maximise reach and engagement. This includes creating shareable content, engaging with users on social platforms, and leveraging social media insights to inform keyword research and content creation.

Emerging Trends and Technologies

The Japanese search engine market is continuously evolving, with new technologies and trends shaping the future of search. Key emerging trends include:

AI and Machine Learning: Advanced AI algorithms improve search accuracy and personalisation. Businesses should stay updated with these technologies to enhance their SEO strategies.

Augmented Reality (AR) and Virtual Reality (VR): AR and VR are becoming more integrated into search experiences, providing users with immersive and interactive content.

Blockchain and Decentralised Search Engines: While still in the early stages, blockchain technology promises to bring greater transparency and security to search engines.

Sustainability and Green SEO: As environmental concerns grow, search engines and users become more conscious of sustainability. Implementing green SEO practices might improve a business’s reputation and search rankings.

Understanding the Japanese search engine market is essential for businesses aiming to succeed in Japan’s digital landscape. By leveraging localised SEO strategies, optimising for mobile and voice search, and staying updated with emerging trends, businesses can effectively navigate this unique market and achieve their digital marketing goals.

FAQ Section

What is the Japanese search engine market?

The Japanese search engine market refers to the collection of search engines and the ecosystem surrounding search behaviour, SEO strategies, and digital marketing practices specific to Japan. It includes major players like Google, Yahoo! Japan, and Bing, each catering to unique segments of users with distinct preferences and behaviours influenced by cultural nuances.

Who are the key players in the Japanese search engine market?

The key Japanese search engine market players are Google, Yahoo! Japan, and Bing. Google holds the largest market share due to its accurate search results and user-friendly interface. Yahoo! Japan, although using Google’s search algorithms, remains popular due to its local services. Bing has grown, especially in desktop searches, due to its integration with Windows OS and AI advancements.

What are the market share trends in the Japanese search engine market?

As of May 2024, Google dominates the Japanese search engine market with a stable market share, averaging around 77%. Bing has overtaken Yahoo! Japan in desktop searches, holding a 21.17% market share compared to Yahoo! Japan’s 6.33%. Yahoo! Japan maintains a significant share of mobile at 12.94%, while Bing has 0.75%.

How can businesses optimize their SEO strategies for the Japanese market?

Businesses can optimize their SEO strategies for the Japanese market by focusing on local keyword research, content localization, mobile optimization, leveraging Yahoo! Japan’s ecosystem, building high-quality backlinks, and utilizing multimedia. Understanding cultural nuances and using Japanese-specific keywords in Kanji, Hiragana, and Katakana are essential for effective SEO in Japan.

What is the role of mobile search in Japan?

Mobile search plays a critical role in Japan due to the widespread use of smartphones. Businesses must ensure their websites are responsive and optimized for mobile to capture this significant market segment. Mobile optimization includes fast loading times, easy navigation, and mobile-friendly content formats to improve user experience and engagement.

Ready to learn how to launch, integrate and scale your business in Japan?

Download our intro deck and contact ULPA today to understand how we will help your company learn the rules of business in Japan, and then redefine those rules.

Let The Adventure Begin.

Comments